12 January 2026

12 January 2026

Cheque Bounce Law in India: Rights, Risks & Recovery

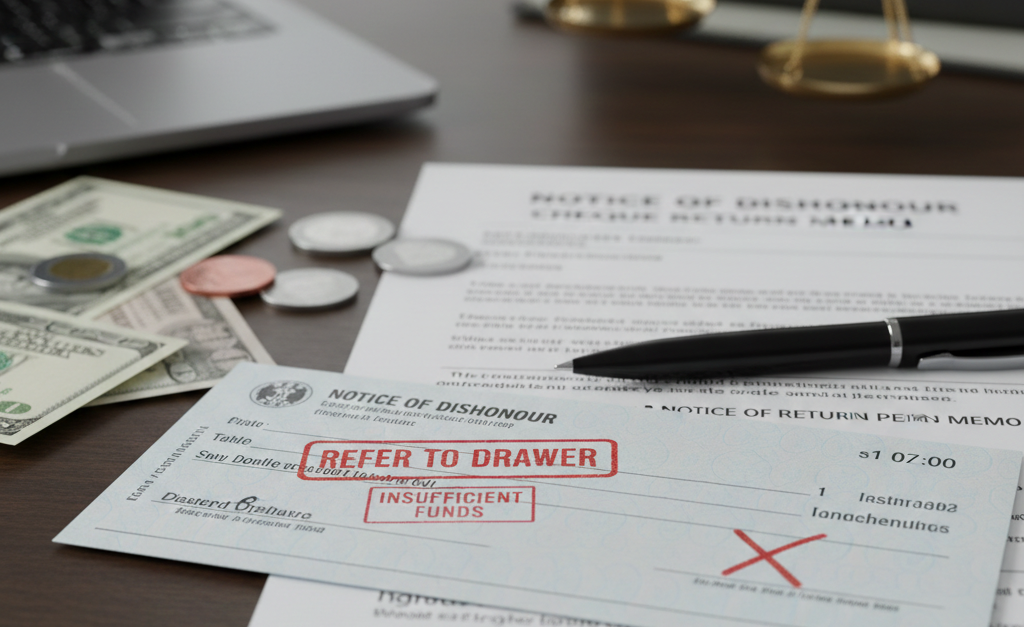

Cheque bounce cases are among the most common financial disputes in India and are governed by Section 138 of the Negotiable Instruments Act, 1881. The law aims to ensure credibility in financial transactions and protect the rights of payees when cheques are dishonoured due to insufficient funds or other valid reasons.

A cheque is considered dishonoured when the bank returns it unpaid due to reasons such as insufficient balance, account closure, or mismatch of signatures. Upon dishonour, the payee must issue a legal demand notice within 30 days from the date of receiving the bank memo. If the drawer fails to make payment within 15 days of receiving the notice, a criminal complaint can be filed.

The offence under Section 138 is criminal in nature, punishable with imprisonment up to two years, fine up to twice the cheque amount, or both. At the same time, the law provides effective recovery mechanisms for the complainant, including compensation and settlement through mediation.

Courts consider factors such as the legally enforceable debt, validity of the cheque, and compliance with statutory timelines. Accused persons also have the right to defend themselves by proving absence of liability or procedural lapses.

Recent legal developments emphasize speedy trials and compounding of offences, encouraging amicable settlement and reducing litigation burden. Digital evidence and summary procedures have further streamlined cheque bounce proceedings.

In conclusion, cheque bounce law in India strikes a balance between financial discipline and fair recovery. Timely legal action, proper documentation, and expert legal guidance play a crucial role in protecting rights and ensuring effective recovery.